Mergers & Acquisitions Warning Signs

March 21, 2025

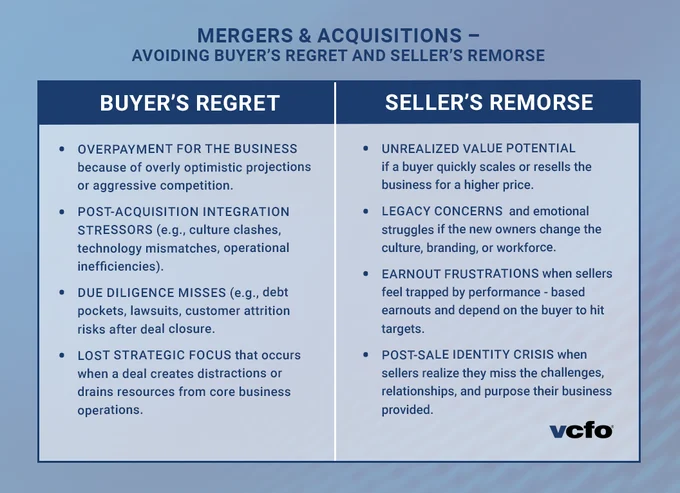

Mergers & Acquisitions – Avoiding Buyer’s Regret and Seller’s Remorse

Study after study shows that most mergers and acquisitions (M&A) deals fail or never fully live up to the expectations of one or more parties involved in the transaction. A successful deal outcome often falls prey to strategic, financial, operational, and cultural challenges. In other cases, human factors rise to the top of why people find themselves bewildered and disappointed on the how-did-this-happen side of the post-deal spectrum.

Here, we look at buyer’s remorse and seller’s regret in M&A, how human factors get in the way of successful deals, why the right transaction team matters, and when to say “let’s walk away” from a potential transaction. As my many years of experience as a transaction advisor for buyers and sellers of businesses has taught me, no deal is sometimes the best deal.

Buyer’s Remorse and Seller’s Regret

Buyers and sellers don’t typically pursue potential transactions with hopes that a deal will never happen or that one side will emerge as a clear victor while the other is left to bow in shame or defeat. Nonetheless, the story of buyers and sellers contending with post-deal turmoil or being saddled with guilt or anger over what went wrong plays out repeatedly. Below are just some ways that Buyer’s Regret and Seller’s Remorse emerge when bad deals happen.

Human Factors that Foster Deal Failure

It’s all too easy for buyers and sellers to rationalize a bad acquisition if they see backing out of a potential deal as a personal or business failure. Keeping yourself and your business out of bad situations is never a failure. Despite that fact, human factors can rear their ugly heads in many ways that lead to unsuccessful deals, including:

- Overconfidence Bias that finds executives overestimating their ability to make a deal work, even if lacking needed experience or facing operational or cultural barriers.

- Confirmation Bias that occurs when decision-makers focus only on items that support their desire to proceed while ignoring warning signs or negative due diligence findings.

- Anchoring Bias where a buyer or seller fixates on an initial valuation or price, even when new information suggests it’s inaccurate or unrealistic.

- Sunk Cost Fallacy that leads decision-makers to continue with a deal despite red flags because they’ve already invested significant time and resources.

- Endowment Effect where emotional attachments cause sellers to overvalue their company or resist post-sale changes that differ from “the way we’ve always done it.”

Self-awareness and a high emotional quotient (EQ) are important to keep biases, pride, and other emotions from pushing you over the edge to blow a deal up prematurely or push ahead when you should walk away. The latter often entails “Deal Creep,” which happens when buyers or sellers put themselves in a poor position by unknowingly or unwittingly trading down/up or straying from the original deal parameters so much that the deal then on the table bears little or no resemblance to the one they envisioned at the outset of the process.

Assemble an Experienced M&A Transaction Team

A warning sign that should signal a buyer or seller to walk away from a potential transaction is when the other party in the deal discussion does not have substantial deal experience or bring anyone to the table with them that does. M&A or transaction fluency is not something to learn on the fly or improvise. Forging ahead without specialized expertise from independent advisors in spaces such as investment banking, finance, M&A strategy, and strategic HR considerations is a recipe for chaos and an unsuccessful outcome.

Having the right fractional CFO and fractional HR advisors engaged is highly recommended. These experts can help sellers identify and address the areas of their business that are holding them back from getting the best deal possible and help buyers gain a clear view of risks, accurate valuation, and expected outcomes across different deal scenarios. The right fractional CFO and fractional HR advisors are also able to provide objective guidance through every phase of a transaction – before, during, and after – to see it through with minimal friction or highlight fail points and goal targets early on that allow you to exit a deal before investing more energy and resources than you have to.

Stack the M&A Odds in Your Favor

Don’t let M&A missteps keep you and your business from completing a successful transaction. How? Understand how doors are left open for buyer’s remorse and seller’s regret to creep in. Be aware and able to manage the human factors that can cause deals to go off the rails or force their way forward when they shouldn’t. Put the right team of M&A experts on your side to help you get what you want or get out before it hurts. Remember… no deal is sometimes the best deal.

—

Want deeply experienced M&A experts in your corner to help you find, prepare for, and navigate the best possible deal for your business? Request a Free Consultation with a specialized vcfo expert. We’ve partnered with leaders from more than 6,000 businesses in our 29-year history and are ready to put our experience to work for you.